sultancbr.ru Market

Market

Afterpay Merchant List

Search your favourite brands or products to find a list of leading Afterpay Stores. You can now simply and easily find popular Afterpay Stores for just about. Can I pay in store at Target with Afterpay in my Apple Wallet? Hi Target isn't a store in the list anymore (for me anyway). Upvote 1. Fashion & Clothing · Forever 21 · J Crew · Cettire · Old Navy. Online · More Fashion Stores with Afterpay. Shoes & Footwear. Afterpay Merchant FAQ Content What is Installments with Afterpay? How do I use Installments with Afterpay? Simply shop online and add items to your shopping. payment list if the customer's country is US, otherwise hide the Afterpay option Afterpay has additional rules for merchant eligibility for Afterpay. If. Boohoo Man is an international online fashion retailer that offers a wide range of menswear items. From cargos to cardigans, you can virtually find every item. Stores That Accept Afterpay · Adidas · Alfa Western Wear · Anthropologie · American Eagle · Aerie · Alex and Ani · Aveda · Arait. list of restricted items, however, it says: "Merchants may not use the We have been using Afterpay online and in-store with no real issues since it. Discover the full list of Most popular retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees. Search your favourite brands or products to find a list of leading Afterpay Stores. You can now simply and easily find popular Afterpay Stores for just about. Can I pay in store at Target with Afterpay in my Apple Wallet? Hi Target isn't a store in the list anymore (for me anyway). Upvote 1. Fashion & Clothing · Forever 21 · J Crew · Cettire · Old Navy. Online · More Fashion Stores with Afterpay. Shoes & Footwear. Afterpay Merchant FAQ Content What is Installments with Afterpay? How do I use Installments with Afterpay? Simply shop online and add items to your shopping. payment list if the customer's country is US, otherwise hide the Afterpay option Afterpay has additional rules for merchant eligibility for Afterpay. If. Boohoo Man is an international online fashion retailer that offers a wide range of menswear items. From cargos to cardigans, you can virtually find every item. Stores That Accept Afterpay · Adidas · Alfa Western Wear · Anthropologie · American Eagle · Aerie · Alex and Ani · Aveda · Arait. list of restricted items, however, it says: "Merchants may not use the We have been using Afterpay online and in-store with no real issues since it. Discover the full list of Most popular retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees.

Find the section labeled “Shop in Afterpay app” and click on the black and white arrow to the right. This will list all of the merchants that are available only. See here for complete terms. Afterpay Merchant FAQ Content. What is Afterpay list of FAQs, Terms, Installment Agreement as well as Afterpay's. Just adding my name to the growing list of Australian merchants wanting AfterPay integration. Here's the response I received from AfterPay today.. "We are. Find the section labeled “Shop in Afterpay app” and click on the black and white arrow to the right. This will list all of the merchants that are available only. Retailer pages · Self-Lounge Company · SensuousPlayroom · Sephora · Sewedup Inc. · SFP Fishing Tools and Accessories · Shaded Eyez Online Eyewear Boutique · Shamrock. It was reported that Molnar and Eisen will lead Afterpay's merchant and consumer businesses inside Square. "Afterpay Lists on ASX". PowerRetail. Afterpay app. GET THE AFTERPAY APP ; Afterpay online shopping. SHOPPING ONLINE? ; Afterpay in-store shopping. SHOPPING IN-STORE? ; Afterpay pay your way. CHOOSE. Afterpay Access delivers small business advice, insights and success stories for Afterpay merchants. Store directory · Account login. Support. Help · Guide. list. Managing customers · Customer groups · Importing customers While customers pay for their orders to Afterpay in instalments, you as a merchant. Afterpay Merchant ID: Your unique Merchant Identification number assigned to you by Afterpay. Exporting your product list from Retail POS (X-Series) · Fixing. Afterpay is fully integrated with all your favorite stores. Shop as usual, then choose Afterpay as your payment method at checkout. Discover the full list of Pay Monthly retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees. Sign up to our email list to be the first to know about new releases, promotions, exclusive deals, and events. Women's. Men's. Store Directory. BUSINESSES. Become a Zip Merchant · Merchant Sign In · Merchant Resources · Documentation · API Reference · PCI DSS Compliance. ABOUT ZIP. Afterpay is only offered to our customers who have a US billing address, US shipping address, a US Visa or Mastercard (credit or debit card), or American. If you choose to use Afterpay, you must agree to the Afterpay Merchant Terms. list their storefront and products on the Afterpay app in the future. Are. Enter the Merchant ID provided by Afterpay into the 'Merchant ID' field. Locate the 'Afterpay Gateway for WooCommerce' in the plugin list. Note: The. Product List · Single-Channel List · Catalog Search. Store Setup Enter the credentials from your Afterpay merchant account into their corresponding Merchant. Know exactly what you're looking for, or seeking style inspiration? Check out our store directory to shop now and pay later at hundreds of brands with Zip. Afterpay Merchant ID: Your unique Merchant Identification number assigned to you by Afterpay. Exporting your product list from Retail POS (X-Series).

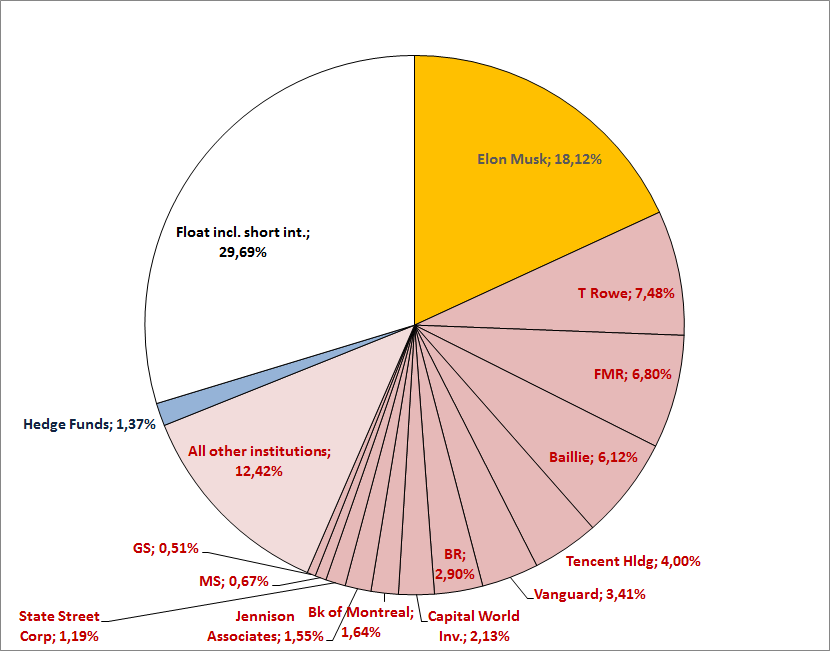

Tesla Ownership Structure

Tesla, Inc. (US:TSLA) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These. shareholders are supporting a plan to award Elon Musk a compensation While Teslas ownership structure and the long- term nature of its business. Tesla (NASDAQ: TSLA) is owned by % institutional shareholders, % Tesla insiders, and % retail investors. Elon Musk is the largest individual. The chart below indicates Tesla's ownership structure of the remaining section after holding companies. The largest stakeholder is Baillie Gifford & Co. Musk owns approximately 20 percent of the outstanding shares of Tesla (outstanding stock options were not included in calculating this percentage). Based on. Tesla vehicles have a low cost of ownership compared to gas vehicles Tesla vehicles are designed with a rigid structure and low center of gravity. Find the latest institutional holdings data for Tesla, Inc. Common Stock (TSLA) including shareholders, ownership summaries, and holding activities at Nasdaq. In February , Elon Musk joined as Tesla's largest shareholder; in , he was named chief executive officer. Ownership structure. 14 See also; Shareholders: Tesla, Inc. ; Elon Musk. %. ,,, % ; Vanguard Fiduciary Trust Co. %. ,,, % ; BlackRock Advisors LLC. %. Tesla, Inc. (US:TSLA) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These. shareholders are supporting a plan to award Elon Musk a compensation While Teslas ownership structure and the long- term nature of its business. Tesla (NASDAQ: TSLA) is owned by % institutional shareholders, % Tesla insiders, and % retail investors. Elon Musk is the largest individual. The chart below indicates Tesla's ownership structure of the remaining section after holding companies. The largest stakeholder is Baillie Gifford & Co. Musk owns approximately 20 percent of the outstanding shares of Tesla (outstanding stock options were not included in calculating this percentage). Based on. Tesla vehicles have a low cost of ownership compared to gas vehicles Tesla vehicles are designed with a rigid structure and low center of gravity. Find the latest institutional holdings data for Tesla, Inc. Common Stock (TSLA) including shareholders, ownership summaries, and holding activities at Nasdaq. In February , Elon Musk joined as Tesla's largest shareholder; in , he was named chief executive officer. Ownership structure. 14 See also; Shareholders: Tesla, Inc. ; Elon Musk. %. ,,, % ; Vanguard Fiduciary Trust Co. %. ,,, % ; BlackRock Advisors LLC. %.

On paper, Tesla is owned by its shareholders. However, in reality, Tesla is effectively owned by one person: Elon Musk. Musk is the largest shareholder in Tesla. How to structure an award in a way that would further align the interests of Mr. Musk's future potential ownership of Tesla common stock will be. Tesla can change elon musk's pay package so that instead of being paid in normal tesla shares, he is paid in the tesla shares that don't have. Parent Company Name: Tesla Inc. Ownership Structure: publicly traded (ticker symbol Nasdaq: TSLA) Headquartered in: California Major Industry: motor. Major Holders ; %, % of Shares Held by All Insider ; %, % of Shares Held by Institutions ; %, % of Float Held by Institutions ; 3,, Number of. Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China. Structure and Ownership · Corporate Presentations; Financials. Annual · Quarterly TESLA AND TALON METALS ENTER INTO SUPPLY AGREEMENT FOR NICKEL. Talon. We advise Tesla shareholders to vote with management recommendations. To learn more, please read our Proxy Statement. Tesla share holder equity for was $B, a % increase from Compare TSLA With Other Stocks. Tesla's financial strategy of patience and long-term investing seems to have paid off. Tesla must continually increase efficiency, reduce cost, and expand. The Board of Directors of Tesla, Inc. sets high standards for the Company's employees, officers and directors. Ownership Breakdown ; Private Companies, 3,, % ; State or Government, 2,,, % ; Individual Insiders, ,,, 13% ; General Public. Tesla's financial strategy of patience and long-term investing seems to have paid off. Tesla must continually increase efficiency, reduce cost, and expand. Major shareholders: TESLA, INC. ; BlackRock Life Ltd. %. 39,,, % ; Capital Research & Management Co. (World Investors). %. 39,, Ownership Breakdown ; Private Companies, 3,, % ; State or Government, 2,,, % ; Individual Insiders, ,,, 13% ; General Public. They would continue to have separate ownership and governance structures. However, the structure envisioned for Tesla is similar in many ways to the SpaceX. Tesla Shareholder ; The Vanguard Group, Inc. ; Vanguard Group, Inc. (Subfiler), ; State Street Corp. ; Vanguard Total Stock Market ETF, This is why the executive compensation plans at Tesla are almost exclusively performance-based LTIPs in the form of stock options awards. Moreover, the company. Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. Let me start that I am a Tesla driver, and a Starlink owner. I am not critiquing Musk's ownership structure or his approach.

Credit Card With 0 Interest Balance Transfer

Our lowest intro APR on balance transfers and purchases Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard. BECU does not charge Balance Transfer fees. We will apply minimum payments at our discretion, and we will apply amounts that exceed the minimum payment amount. Here's how it works: If you have credit card debt on high-interest credit cards, you can transfer that debt to a 0% introductory annual percentage rate balance. An interest-free balance transfer card works best if you can pay off the balance in full by the end of the 0% period, because after this the rate is likely to. Chase Freedom Unlimited®. Visa Signature®. Visa Infinite®. Chase Freedom Unlimited®. INTRO PURCHASE APR. 0% Intro APR on Purchases for 15 months ; Wells Fargo. 0% Intro APR Card Offers (5) ; Blue Cash Everyday® Card. No Annual Fee · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) ; Blue Cash. Balance transfer credit cards ; Citi Simplicity® Card · reviews · Intro balance transfer APR. 0% for 21 Months · % - %* Variable ; Citi Rewards+® Card. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Our lowest intro APR on balance transfers and purchases Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard. BECU does not charge Balance Transfer fees. We will apply minimum payments at our discretion, and we will apply amounts that exceed the minimum payment amount. Here's how it works: If you have credit card debt on high-interest credit cards, you can transfer that debt to a 0% introductory annual percentage rate balance. An interest-free balance transfer card works best if you can pay off the balance in full by the end of the 0% period, because after this the rate is likely to. Chase Freedom Unlimited®. Visa Signature®. Visa Infinite®. Chase Freedom Unlimited®. INTRO PURCHASE APR. 0% Intro APR on Purchases for 15 months ; Wells Fargo. 0% Intro APR Card Offers (5) ; Blue Cash Everyday® Card. No Annual Fee · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) ; Blue Cash. Balance transfer credit cards ; Citi Simplicity® Card · reviews · Intro balance transfer APR. 0% for 21 Months · % - %* Variable ; Citi Rewards+® Card. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that.

0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Which Capital One balance transfer credit card is best for you? ; CREDIT LEVEL ; EXCELLENT, EXCELLENT, EXCELLENT ; PURCHASE RATE ; 0% intro APR for 15 months; Transfer your balance to an Altra Visa Credit Card and enjoy a fixed balance transfer rate as low as % APR and no balance transfer fees. Cards like Citizens Clear Value® Mastercard® could be a top consideration if you want to transfer a balance. For instance, it offers an month 0% APR, which. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. After that, %, If you do not pay off a 0% balance transfer balance within 12 months of the transfer, the remaining balance will then be subject to the Standard Rate, and you. How much could I save with no balance transfer fee and a low intro APR? · You could save $1, when you transfer a balance to a Navy Federal Credit Card. 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - % based on your creditworthiness. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money by having. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. The Wells Fargo Reflect lets you skip interest on purchases and balance transfers for 21 months. 5 min read Jul 09, Shot of a young. Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. 10 partner offers ; Blue Cash Preferred Card from American Express · 0% on Purchases and Balance Transfers for 12 months ; Citi Diamond Preferred Card · 0% for Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. If researched thoroughly, zero percent or low-interest credit card balance transfer can be a good way to combine multiple, higher-interest credit card balances. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. Qualify for balance transfer rates as low as 0% APR* based on creditworthiness for 12 months and pay down your debt faster. Plus, credit union rates are.

About Simplilearn

Simplilearn is a great option for those looking to expand their knowledge and skills in a variety of topics. The courses are comprehensive, easy to follow, and. Download the APK of Simplilearn for Android for free. High-quality online courses and free educational resources. Simplilearn is an online learning app for. Simplilearn is a great platform to build overall know how on any topic. Its online courses are very much relevant and I would definitely say. The quality of the content was top-notch, and the instructor Dhruvik Parikh is incredibly knowledgeable and engaging. I would highly recommend Simplilearn. Simplilearn is the popular online Bootcamp & online courses learning platform that offers the industry's best PGPs, Master's, and Live Training. Simplilearn, San Francisco, California. likes · 78 talking about this. We are the world's #1 online bootcamp for digital skills training. Simplilearn is the world's #1 online bootcamp for digital skills and certification training, helping individuals and corporate teams acquire the skills they. Simplilearn is the world's #1 online bootcamp for digital economy skills training focused on people acquiring skills they need to thrive in the digital world. Founded in , Simplilearn is one of the world's leading providers of online training for Digital Marketing, AI and Machine Learning, Cloud Computing. Simplilearn is a great option for those looking to expand their knowledge and skills in a variety of topics. The courses are comprehensive, easy to follow, and. Download the APK of Simplilearn for Android for free. High-quality online courses and free educational resources. Simplilearn is an online learning app for. Simplilearn is a great platform to build overall know how on any topic. Its online courses are very much relevant and I would definitely say. The quality of the content was top-notch, and the instructor Dhruvik Parikh is incredibly knowledgeable and engaging. I would highly recommend Simplilearn. Simplilearn is the popular online Bootcamp & online courses learning platform that offers the industry's best PGPs, Master's, and Live Training. Simplilearn, San Francisco, California. likes · 78 talking about this. We are the world's #1 online bootcamp for digital skills training. Simplilearn is the world's #1 online bootcamp for digital skills and certification training, helping individuals and corporate teams acquire the skills they. Simplilearn is the world's #1 online bootcamp for digital economy skills training focused on people acquiring skills they need to thrive in the digital world. Founded in , Simplilearn is one of the world's leading providers of online training for Digital Marketing, AI and Machine Learning, Cloud Computing.

Simplilearn offers + certification courses in Project Management, IT Service Management, Microsoft Certification, Quality Management, Financial Management. Do you agree with simplilearn's 4-star rating? Check out what people have written so far, and share your own experience. Simplilearn offers access to world-class work-ready training to individuals and businesses worldwide. Partnering with world-renowned universities, top. Simplilearn Simplilearn is the world's #1 online bootcamp for digital skills training, focused on helping individuals and teams acquire the skills they need. Simplilearn keeps things easy by offering direct-enroll classes that you can begin immediately, at your own schedule — without the hassle of applying. Simplilearn is an online learning platform created to help learners acquire new skills and upskill current skills. It provides hundreds of courses online. Simplilearn enables professionals and enterprises to succeed in the fast-changing digital economy. Based in San Francisco and Bangalore, India, Simplilearn has. Simplilearn is an educational technology company with a focus on courses for digital skills. This section provides access to all the insightful resources that are created by the in-house subject matter experts at Simplilearn. K Followers, Following, Posts - Simplilearn (@simplilearn_elearning) on Instagram: "World's leading digital skills platform. Simplilearn Courses. Simplilearn offers a wide range of excellent courses to choose from. Part-time courses include Executive Certificate Program in General. Simplilearn - Skillup. Explore. Close. Sign up Log in. Learn today's most in-demand skills with our free online courses. Explore Free Courses. Not sure where to. Share your honest Simplilearn reviews with us. Your review will not only help us improve but also assist fellow learners in making informed decisions. Simplilearn, one of the world's leading certification providers, offers short-term online training courses to help professionals get certified and get. Simplilearn is a leading online learning platform that provides professional certification courses in various fields such as Artificial Intelligence, Digital. Discover what it's like to work at Simplilearn. Get insights into Simplilearn culture, salaries, career opportunities, interview questions, employee reviews. Find out what works well at SimpliLearn from the people who know best. Get the inside scoop on jobs, salaries, top office locations, and CEO insights. Simplilearn Solutions Private Limited Simplilearn is the world's leading professional certifications training organization. We help companies and working. Simplilearn · Top 10 Technologies To Learn And Top 10 Certifications For | Simplilearn · Top 10 Trending Videos #Trending # | Simplilearn. The San Francisco based startup Simplilearn is an edu-tech startup which allows its consumers to upskill their education.

Refinance Home And Pull Money Out

Homeowners look to cash-out refinancing to turn some of their home equity into cash. It works by refinancing your mortgage at a higher amount. The new loan pays. The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. A cash-out refinance mortgage loan can help you consolidate debt, remodel your home, pay for college, make a large purchase, or even buy another property. Yes. You can often use cash out refinances to help you consolidate debts—especially when you have high-interest debts from credit cards or other loans. That's. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you. Homeowners look to cash-out refinancing to turn some of their home equity into cash. It works by refinancing your mortgage at a higher amount. The new loan pays. The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. A cash-out refinance mortgage loan can help you consolidate debt, remodel your home, pay for college, make a large purchase, or even buy another property. Yes. You can often use cash out refinances to help you consolidate debts—especially when you have high-interest debts from credit cards or other loans. That's. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you.

A cash-out refinance, in which you will refinance your mortgage for a larger amount than the existing mortgage loan, frees up a portion of your existing home. Key takeaways · A cash-out refinance loan — AKA a cash-out refi — is when you refinance your existing mortgage for more than you owe and take the difference in. Although a cash-out refinance has a higher upfront cost than a home equity mortgage, cash-out refinancing comes with lower out-of-pocket monthly payment. Like a typical refinance loan, a mortgage cash out can lower your interest rate, minimize your payment amount, or shorten the length of your loan. However, with. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. A cash-out refinance is a type of home loan product that swaps out your current mortgage for a mortgage, typically with different terms than you currently have. With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the things. Cash-out refinancing requires going through the mortgage application process again, including appraisal and closing costs, whereas home equity loans usually. In a cash-out refinance you exchange your old mortgage for a new mortgage. This means that your interest rate and monthly payment will likely change as well. A cash-out refinance is a new mortgage (replacing your old one) that lets you borrow extra money as part of the mortgage. · A fixed home equity loan is a loan. For example, if you have a $, mortgage balance and a large amount of home equity, you could refinance to a $, mortgage and get $50, in cash. Cash. A cash-out refinancing pays off your old mortgage in exchange for a new mortgage, ideally at a lower interest rate. A home equity loan gives you cash in. Lenders usually require you to have at least 20% equity in your home after closing on the cash-out refinance, which limits how much you can borrow. Here's a. Cash-out refinancing is when a homeowner refinances their mortgage to a new mortgage and in the process borrows more money than what is needed to pay off the. For a cash-out refinance, the borrower takes out an entirely new mortgage while borrowing a portion of their existing home equity. The total borrowed amount of. These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out. A cash-out refinance allows you to get cash out of your home using your home's equity. You can use this cash to make repairs or remodel your home. Every type of home loan, whether it's a purchase or refi, requires the borrower to pay closing costs and lender fees. A cash-out refinance is no exception. As. Cash out refinancing is when you take out a loan worth more than your original mortgage. You use the loan to repay the original mortgage and the remaining cash. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. The.

Is It Cheaper To Book Flights On Weekdays

The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. Usually, you should book tickets at least days in advance to get affordable flights. Those who are planning to travel during the peak season should book. Consumers have a range of options when it comes to booking airline tickets. · For the least expensive fares on flights to destinations in North America, book. Free Wi-Fi? Early arrival? Instantly customize your results. Track prices. Not ready to book? Set alerts for. What is the cheapest day to buy plane tickets? Any day of the week. Booking on one day versus another isn't going to make a difference. "That used to be true;. The airfare prices have a weekly rhythm. The cheapest flight tickets are typically offered early on the weekdays, and the most expensive fares are provided. Sunday is the most expensive day to fly domestically and internationally. It could even mean paying twice as much for a domestic flight as flying during the. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will. No that's not true. Cheapest fares are generally on Wednesday with the most expensive fares being on weekends and Friday nights. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. Usually, you should book tickets at least days in advance to get affordable flights. Those who are planning to travel during the peak season should book. Consumers have a range of options when it comes to booking airline tickets. · For the least expensive fares on flights to destinations in North America, book. Free Wi-Fi? Early arrival? Instantly customize your results. Track prices. Not ready to book? Set alerts for. What is the cheapest day to buy plane tickets? Any day of the week. Booking on one day versus another isn't going to make a difference. "That used to be true;. The airfare prices have a weekly rhythm. The cheapest flight tickets are typically offered early on the weekdays, and the most expensive fares are provided. Sunday is the most expensive day to fly domestically and internationally. It could even mean paying twice as much for a domestic flight as flying during the. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will. No that's not true. Cheapest fares are generally on Wednesday with the most expensive fares being on weekends and Friday nights.

Book your next getaway and Love where you're going. Book a flight. Sign in to apply companion vouchers. To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a few months in advance for international travel. For international flights, Monday through to Wednesday are almost always cheaper than weekend departures. cost you more than you save by booking a cheap. You probably knew about the first rule, but did you know that it is best to book your flights on a weekend? While the most expensive tickets tend to be booked. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Best flight times and flight days. There may be serious differences between the weekend and weekdays in terms of both flight fares and flight schedules. Flying on a weekday will be cheaper than flying on a public holiday or at the weekend. The best time to fly is from Tuesday to Thursday. The most expensive day. Google Flights does state that Tuesdays are typically the cheapest day of the week to book, according to the data, but Tuesday bookings are only % cheaper. AirHint tracker and predictor recommends the best time to buy airline tickets. We track and analyze airfares, predicts plane ticket price changes and offers. For both U.S. domestic and international travel, Sundays can be cheaper for airline ticket purchases. Fridays tend to be the most expensive day to book a flight. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. You may not get cheaper airfare by booking on a specific day, but when you plan on flying can affect the price of the ticket. Generally, Mondays and Fridays are. Yeah, first, always book your tickets for Tuesdays, Wednesdays, and Saturdays. These are by far the cheapest days to book tickets. Wow, what. The end of the week (Wednesday, Thursday and Friday) is suited best for catching your flights. For domestic travels, the cheapest day to travel depends on the. Airfares offered on Thursdays tend to be the cheapest, according to flight demand on Travelocity in Tuesday and Wednesday prices are also good. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will. Airfares offered on Thursdays tend to be the cheapest, according to flight demand on Travelocity in Tuesday and Wednesday prices are also good. To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a few months in advance for international travel. Remember that it's cheaper to fly on a weekday. Flying on a weekday will be cheaper than flying on a public holiday or at the weekend. The best time to fly is. According to our data, Sunday is the cheapest day of the week to book flights, but once again, it depends on your destination. If you are flexible around what.

Socially Conscious Index Funds

1. iShares ESG Aware MSCI USA ETF · 2. SPDR S&P ESG ETF · 3. Fidelity U.S. Sustainability Index Fund · 4. Vanguard FTSE Social Index Fund Admiral Shares · 5. Once you choose a portfolio, you can customize it with hundreds of investments like these. ; QCLN. First Trust NASDAQ Clean Edge Green Energy Index Fund. Global. Each option was identified in Morningstar as Socially Conscious; mutual funds are rated 3 stars or higher. Vanguard FTSE Social Index Fund. VFTNX. Socially responsible investing or impact investing, depends on the degree of responsibility you want to deliver. If you want to be fully. Sustainable investing integrates environmental, social, and governance factors into investment research and decision making. We believe these factors can be. Key Takeaways · Socially responsible investing is the practice of investing money in companies and funds that have positive social impacts. · Socially responsible. 7 Great Low-Fee Socially Responsible Investment Funds ; Parnassus Endeavor Investor (PARWX) ; Parnassus Mid-Cap (PARMX) ; SPDR SSGA Gender Diversity Index (SHE). There are four main types of sustainable index funds: broad market ESG index funds, thematic ESG index funds, low carbon index funds, and green bonds index. Fidelity's sustainable investing funds allow you to invest in companies that are invested in environmental, social, or governance themes. Learn more here. 1. iShares ESG Aware MSCI USA ETF · 2. SPDR S&P ESG ETF · 3. Fidelity U.S. Sustainability Index Fund · 4. Vanguard FTSE Social Index Fund Admiral Shares · 5. Once you choose a portfolio, you can customize it with hundreds of investments like these. ; QCLN. First Trust NASDAQ Clean Edge Green Energy Index Fund. Global. Each option was identified in Morningstar as Socially Conscious; mutual funds are rated 3 stars or higher. Vanguard FTSE Social Index Fund. VFTNX. Socially responsible investing or impact investing, depends on the degree of responsibility you want to deliver. If you want to be fully. Sustainable investing integrates environmental, social, and governance factors into investment research and decision making. We believe these factors can be. Key Takeaways · Socially responsible investing is the practice of investing money in companies and funds that have positive social impacts. · Socially responsible. 7 Great Low-Fee Socially Responsible Investment Funds ; Parnassus Endeavor Investor (PARWX) ; Parnassus Mid-Cap (PARMX) ; SPDR SSGA Gender Diversity Index (SHE). There are four main types of sustainable index funds: broad market ESG index funds, thematic ESG index funds, low carbon index funds, and green bonds index. Fidelity's sustainable investing funds allow you to invest in companies that are invested in environmental, social, or governance themes. Learn more here.

Socially responsible ETFs invest in the equity of companies that consider financial returns as well as social good. The term 'socially responsible' is used. TLDW ESG investing tilts you towards known risk factors with increased expected returns over time, BUT because ESG funds are bid up in price. Responsible investing incorporates Environmental Social Governance (ESG) factors that may affect exposure to issuers, sectors, industries, limiting the type and. Socially Responsible Equity ; Global X Nasdaq ESG Covered Call ETF. QYLE · $ %. $ M · %. $ ; Global X S&P ESG Covered Call ETF. XYLE. Socially responsible mutual funds hold securities in companies that adhere to certain social, moral, religious, or environmental beliefs. To ensure that the. In response to how they are compensated, mutual fund managers who are under-performing by mid-year are likely to increase the risk of their portfolios towards. HCESX | Fund | Other. $ %. $ B. %. -. %. %. %. -. %. Northern Funds - Global Sustainability Index Fd USD Cls K. NSRKX |. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no. Aligning investments with intention Powerful and empowering, responsible investing incorporates environmental, social and governance (ESG) factors into the. The idea is that ecologically and socially responsible management makes a company sustainable and ensures sustainable returns on investment. There are several. Sustainable Investment Mutual Funds and ETFs Chart ; SSIAX, Socially Responsive Balanced Fund - A, Balanced ; SESLX, Socially Responsive Balanced Fund -. A socially conscious index fund is a type of investment fund that selects stocks based on environmental, social, and governance (ESG) criteria, while also. Performance of ESG funds has historically been similar to performance of non-ESG funds. ESG is often used interchangeably with Socially Responsible Investing . Bringing together socially responsible investors across many faiths (Catholic, Episcopalian, Jewish, Mennonite, and more), ICCR members leverage the combined. 1. Russell ® Index is an unmanaged index of 1, U.S. large-cap stocks. Unless otherwise stated, index returns do not reflect the effect of any applicable. I've had a financial advisor who invested our money in sustainable/ conscientious funds and companies- no firearms, fossil fuel, tobacco. Socially responsible investing (SRI) is any investment strategy which seeks to consider financial return alongside ethical, social or environmental goals. The. ETF issuers are ranked based on their estimated revenue from their ETFs with exposure to Socially Responsible. Estimated revenue for an ETF issuer is calculated. Vanguard Equity-Income · VEIPX · % · % · % ; Vanguard FTSE Social Index Fund · VFTSX · % · % · % ; Vanguard Health Care Fund · VGHCX · % · %. Vanguard FTSE Social Index Fund As You Sow's Invest Your Values report card grades mutual funds on environmental and social issues, including climate change.

Which Bank Gives You Money To Open An Account

To receive the bonus: 1) Open a new Chase Total Checking account, which is subject to approval; AND 2) Have your direct deposits totaling $ or more made to. M&T Bank offers several checking account options from interest bearing accounts and accounts with overdraft protection to checkless accounts. Earn up to $ checking account bonus simply by applying online. Choose the checking account right for you and apply today. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. With the all-new Bask Interest Checking, your Bask Visa Debit Card gives you access to your funds anytime, anywhere. Open Account. Earn % APY with Bask. It keeps your money safe, gives you quick access to your funds, saves you money on fees, and brings financial peace of mind. Why bank? Choose an account; Open. Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits. Check cashing and deposits. · Immediate access to your money. · Earn your paycheck up to two days early, without a fee, with Early Pay. · 24/7 mobile and online. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. To receive the bonus: 1) Open a new Chase Total Checking account, which is subject to approval; AND 2) Have your direct deposits totaling $ or more made to. M&T Bank offers several checking account options from interest bearing accounts and accounts with overdraft protection to checkless accounts. Earn up to $ checking account bonus simply by applying online. Choose the checking account right for you and apply today. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. With the all-new Bask Interest Checking, your Bask Visa Debit Card gives you access to your funds anytime, anywhere. Open Account. Earn % APY with Bask. It keeps your money safe, gives you quick access to your funds, saves you money on fees, and brings financial peace of mind. Why bank? Choose an account; Open. Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits. Check cashing and deposits. · Immediate access to your money. · Earn your paycheck up to two days early, without a fee, with Early Pay. · 24/7 mobile and online. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring.

Looking to take control of your finances or earn rewards and extra benefits? At U.S. Bank, either choice for a checking account gives you flexible ways to. Find the best bank bonuses and promotions for September Our guide helps you find current top offers for premium and everyday checking accounts. Visit to open a new TD bank checking account online in minutes! Find the right bank account for your budget, the perks you want and get online banking. BMO Relationship Checking - $ Cash Bonus · Other Checking Account Bonus You May Like · Chase Total Checking® - $ Bonus · Bank of America Advantage Banking -. Wells Fargo: Earn a $ bonus if you open an Everyday Checking account and receive $1, in qualifying electronic deposits within 90 days of opening your. your smartphone Digital Transfers: It's simple to connect your existing bank accounts, so you can transfer money when you need to from an eligible account. With the all-new Bask Interest Checking, your Bask Visa Debit Card gives you access to your funds anytime, anywhere. Open Account. A minimum opening deposit of $25 to activate your account (once you've been approved). This can be paid with a credit, debit or prepaid card, a transfer from. Savings account bonus. Regions LifeGreen® Savings If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum. Discover®Online Savings Account. Up to $ ; Alliant Credit UnionThe Ultimate Opportunity Savings Account. $ ; Huntington National BankChecking Accounts. Up. A business checking account gives you the tools you need to move your business forward · Earn a cash bonus in three steps: · Start by choosing the right checking. U.S. Bank offers as much as $ in cash when you open a new checking account. Here's how to qualify for a U.S. Bank welcome bonus. Checking Bonus: You will not qualify for the Checking Bonus if you are an existing TD Bank personal checking Customer OR had a previous personal checking. Check cashing and deposits. · Immediate access to your money. · Earn your paycheck up to two days early, without a fee, with Early Pay. · 24/7 mobile and online. When you open a bank account with Capital One it means no waiting in line for account access, plus great rates and zero fees - all in one place. Open a new BMO checking account online in minutes and get a cash bonus. Breathe easy knowing we will not penalize you for spending your money. You Choose Your Opening Deposit Amount. Don't break the bank. There is no minimum. Open an account so your money can grow with you. Start saving. Credit card. Credit Cards. Get a card that builds your credit and gives perks at the same time. Find the best bank bonuses and promotions for September Our guide helps you find current top offers for premium and everyday checking accounts. Banking. Savings Accounts. View Guide. Banking. CDs. View Guide. Banking. Checking Accounts. View Guide. faq. Get the answers you need. What is a bounced check?

Anyone Willing To Cosign A Loan

In fact, a cosigner doesn't have to be a relative at all, your cosigner can be anyone who meets the general requirements and is willing to cosign your loan. One way to do that is by asking the applicant if they have a close family member or friend who would be willing and able to co-sign for them. If a co-signer. If you need a cosigner because you have a poor credit history, a cosigner would have to be someone willing to trust you to honor your financial. How Does Using a Cosigner for a Personal Loan Work? Once you've found someone willing to cosign personal loans with you, you can apply for the loan you want. Find a person willing to cosign for you; Apply for a loan with a Cosigner; Join the Cosigner Finder Network. As a Cosigner°member, you get you to create a. You need a co-signer to get that loan or apartment but don't have anyone you can ask. What can you do instead? And how do you decide if it makes sense? You need a co-signer to get that loan or apartment but don't have anyone you can ask. What can you do instead? And how do you decide if it makes sense? Never co-sign a loan you're not ready and willing to pay if the other party falls behind. This is an absolute rule – no exceptions. More than half of co-signed. What does it mean to co-sign a loan? A co-signer is a person who agrees to take legal responsibility for someone else's debt. If the primary borrower fails to. In fact, a cosigner doesn't have to be a relative at all, your cosigner can be anyone who meets the general requirements and is willing to cosign your loan. One way to do that is by asking the applicant if they have a close family member or friend who would be willing and able to co-sign for them. If a co-signer. If you need a cosigner because you have a poor credit history, a cosigner would have to be someone willing to trust you to honor your financial. How Does Using a Cosigner for a Personal Loan Work? Once you've found someone willing to cosign personal loans with you, you can apply for the loan you want. Find a person willing to cosign for you; Apply for a loan with a Cosigner; Join the Cosigner Finder Network. As a Cosigner°member, you get you to create a. You need a co-signer to get that loan or apartment but don't have anyone you can ask. What can you do instead? And how do you decide if it makes sense? You need a co-signer to get that loan or apartment but don't have anyone you can ask. What can you do instead? And how do you decide if it makes sense? Never co-sign a loan you're not ready and willing to pay if the other party falls behind. This is an absolute rule – no exceptions. More than half of co-signed. What does it mean to co-sign a loan? A co-signer is a person who agrees to take legal responsibility for someone else's debt. If the primary borrower fails to.

Family Members: Parents, grandparents, aunts, uncles, and older siblings are often the first people to consider—they usually have a vested interest in your. Having a friend or family member ask you to cosign a loan can trigger a number of questions and concerns. Because someone you care about needs help. Some lenders and lending programs require the cosigner to be a close family member, like a parent, grandparent or sibling. This helps prevent anyone with an. Understanding the risks before agreeing to co-sign is crucial to safeguarding yourself from potential financial hardships. When someone with less-than-ideal. A cosigner is not the main borrower. When you cosign a loan, you agree to be responsible for someone else's debt. If the main borrower misses payments, you must. That's why we always ask for a cosigner on our loans. Being a cosigner for someone means that you believe they're able - and willing - to make the repayments. Adding another person's credit history and income to an application can help you qualify and get a lower rate or higher loan amount. If you plan to take out a loan yourself in the near future, you may not want to co-sign now as it will increase your apparent debt load and could potentially. In some cases, you may need a personal loan with a cosigner. If you have bad credit, a personal loan with a cosigner may be a smart option. How to get a personal loan with a cosigner. A cosigner is someone you add to your personal loan as a guarantee for the lender. You and your cosigner have equal. Anyone over the age of 18 can be a cosigner, as long as they have good credit and are willing to cosign your application. Their information is vetted in the. At first glance, cosigning a loan seems like a win-win. Your friend gets the financing they need, and you get the satisfaction of helping a loved one through a. With a co-signer, the loan has a backup, someone who will pay if the primary borrower doesn't. Lenders like co-signers and are more likely to lend with them. One of the main pros of cosigning a loan is that you can help someone qualify for a loan they would not be able to get on their own. When lenders see that a. A cosigner promises to pay your loan if you can't. As a result, lenders may be more willing to offer you a loan, let you borrow a larger amount, or lower your. If you are applying for a loan or a credit card, and your individual income and/or credit score is not quite high enough to warrant a bank's or creditor's. Do not cosign unless you are able and willing to take over the payments for the loan. How important is my credit score to my financial future? All account. In these instances, having someone cosign may be your only option for actually securing a loan with that specific lender. Even if you are deemed creditworthy. Generally, all the benefit from having a cosigner goes to the borrower and there's usually no benefit to the cosigner except feeling good about helping someone.

Pay Off Mortgage 401k

More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Loan repayment. (k) loans must be repaid within five years unless your plan offers primary residence loans, in which case you have longer to pay it. When paying off your mortgage may not make sense · You have to withdraw money from tax-advantaged retirement plans such as your (b), (k) or IRA. Cashing out your retirement plan to make this happen isn't a good idea. I love that you want to get rid of your car payment, but if you use your (k) they'll. College graduates can successfully manage loan repayment while saving for retirement. You don't have to choose one over the other. The (k) loan has no interest, while the consumer loan has a relatively high one. Paying them off with a lump sum saves interest and financing charges. But. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). Taking money out of a (k) or an IRA to pay off your mortgage is almost always a bad idea if you haven't reached age 59½. You'll owe penalties and income. The CARES Act has made it easier than ever for some individuals to tap retirement funds for paying off their mortgage debt. It is just important to make. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Loan repayment. (k) loans must be repaid within five years unless your plan offers primary residence loans, in which case you have longer to pay it. When paying off your mortgage may not make sense · You have to withdraw money from tax-advantaged retirement plans such as your (b), (k) or IRA. Cashing out your retirement plan to make this happen isn't a good idea. I love that you want to get rid of your car payment, but if you use your (k) they'll. College graduates can successfully manage loan repayment while saving for retirement. You don't have to choose one over the other. The (k) loan has no interest, while the consumer loan has a relatively high one. Paying them off with a lump sum saves interest and financing charges. But. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). Taking money out of a (k) or an IRA to pay off your mortgage is almost always a bad idea if you haven't reached age 59½. You'll owe penalties and income. The CARES Act has made it easier than ever for some individuals to tap retirement funds for paying off their mortgage debt. It is just important to make.

Paying off a mortgage balance with a K balance of the same amount would not be a break-even but would generate a sizeable cash outflow. Cashing out your retirement plan to make this happen isn't a good idea. I love that you want to get rid of your car payment, but if you use your (k) they. A (k) loan does not involve credit checks, and it won't impact your credit score even if you miss a payment. You can borrow a maximum of $50, to pay debts. Your (k) plan may allow you to take a loan. This can be subject to fees and taxes, and, if you change jobs while you have the loan, the whole amount could. Paying off your mortgage early frees up that future money for other uses. Your mortgage rate is higher than the rate of risk-free returns: Paying off a debt. If the interest rate on your debt is 6% or greater, you should generally pay down debt before investing additional dollars toward retirement. · This guideline. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. The more money you take out for a loan, the less your account will appreciate. Paying yourself interest allows your retirement account to stay on track. If you. Leaving your job gives you 60 days to repay your loan in full or else it will be treated as a withdrawal, forcing you to pay the income tax and 10% early. Yes, it's possible to take money out of your (k) to purchase a house outright or cover the down payment on a house. However, be aware that you'll be taxed on. Annual return on retirement account investments: 8%. Annual wage growth: 2%, starting in the second year of the calculation. Additional loan payments apply to. Securing a (k) Loan for a Mortgage Down Payment You can borrow up to 50% of your vested account balance, not exceeding $50, However, the borrowing cap. There's no definitive right answer when it comes to how you prioritize your investments and your mortgage payments. Loans taken under the CARES Act provisions no longer incur penalties as long as they are paid back within the loan's time frame. Individual plans vary on the. There's no definitive right answer when it comes to how you prioritize your investments and your mortgage payments. Well 4 years ago, they announced that they were going to pay off the mortgage on their home by cashing in a big part of his k. I tried to. Lenders of all types allow borrowers to apply money from a K loan to their down payment and closing costs. A (k) participant can decide to pay off a (k) loan early by making extra payments towards the loan repayment. If the plan requires loan payments to be. What are the long-term effects of using a (k) to pay off debt? Using your (k) for debt may seem tempting, but it might hinder your long-term investment.